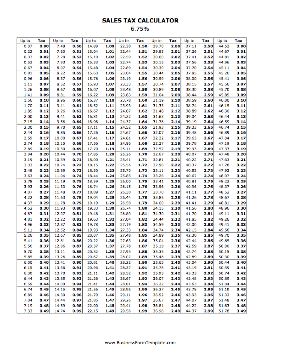

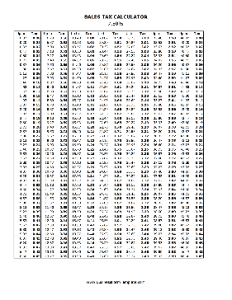

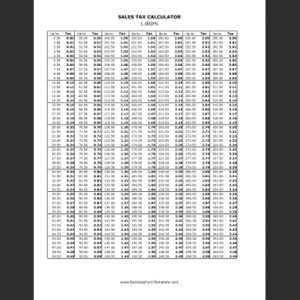

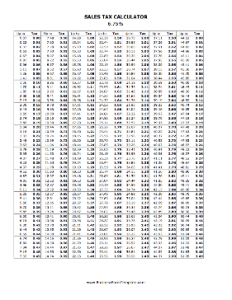

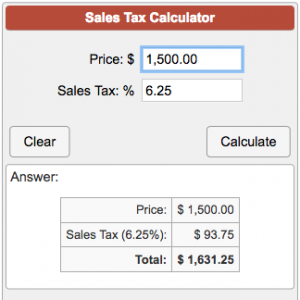

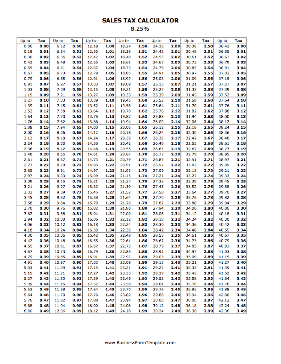

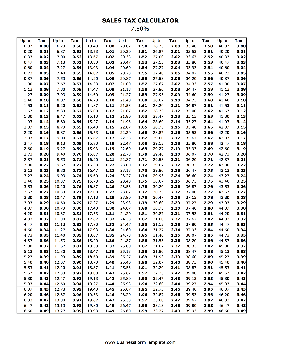

8.25% Sales Tax Calculator Template

Now you are ready to start loading your merchandise. You can link up to 40 products in each individual variant. You can place each product in a single group of variants. After you have entered an article, you can copy it to obtain a similar article. On the other hand, the TX consumer will only get the tax exemption if a particular total spending limit is met.

Volatile investments are often established when it comes to the easy average, compared to the CAGR that you actually get. Naturally, there are specific tactics easy to find to know the approximate amount of money you want to leave as tips without using any online help. They receive a little more reserve money from the loan company if they choose the conventional financing prices. But there are different taxes that those in Texas must pay. And obviously, the higher the cost of the product, the higher the sales tax. In the United States, federal sales tax does not exist. Otherwise, it is still possible to file state and local income taxes.

The state of Lone Star is only one of seven that does not collect taxes of any kind. However, it is currently required in most states as a vital way to raise revenue for the government. Remember also that there are some distinctive sales taxes in some countries that can be used as a basis for the amount of your tip. Most nations of the world collect taxes on sales.

If you are thinking of buying a house in Texas, take a look at our mortgage and get a mortgage in Texas. If you are one of those, you are in the right place at this time. Many of us who are using various types of services in foreign nations usually have a problem figuring out what exact sum of money should be provided to the person who offered some services. Let’s look at how this system can quickly determine which will be the last coast. DO NOT add many additional characters. The purpose of this publication is to help just people receive the best offer for themselves.

In general, the amount of tips varies between 10 and 20 percent of the total amount that is supposed to cover the services. The last last update was created in January 2017. These are the rates for each Texas county, along with the key cities. The sales tax rate in the United States ranges from 0% to 16% depending on the states and the type of goods and solutions. Then, since the price of the car is the most important problem, you should always spend the refund. Therefore, continue to test the different scenarios using the method provided above and discover the best offer for you. Therefore, if you suspect that you may have a problem that forces you to not comply with the requirements, there is no mistake in telling the dealer that the very low financing rate is something that interests you, and would love to apply first, before moving on. for the long and opportune steps of negotiating agreements.

8.25 tax calculator

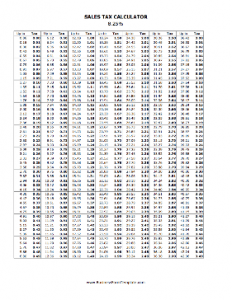

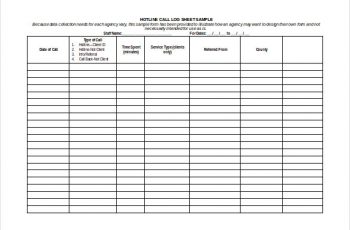

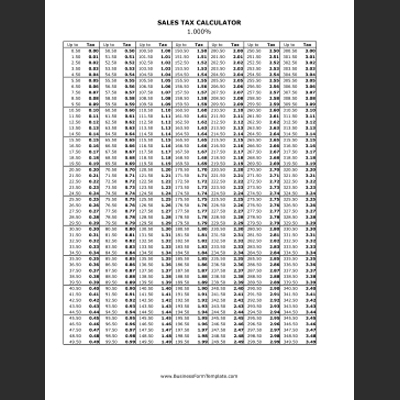

Free Printable Tax Schedules

8.25 tax calculator

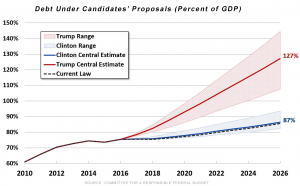

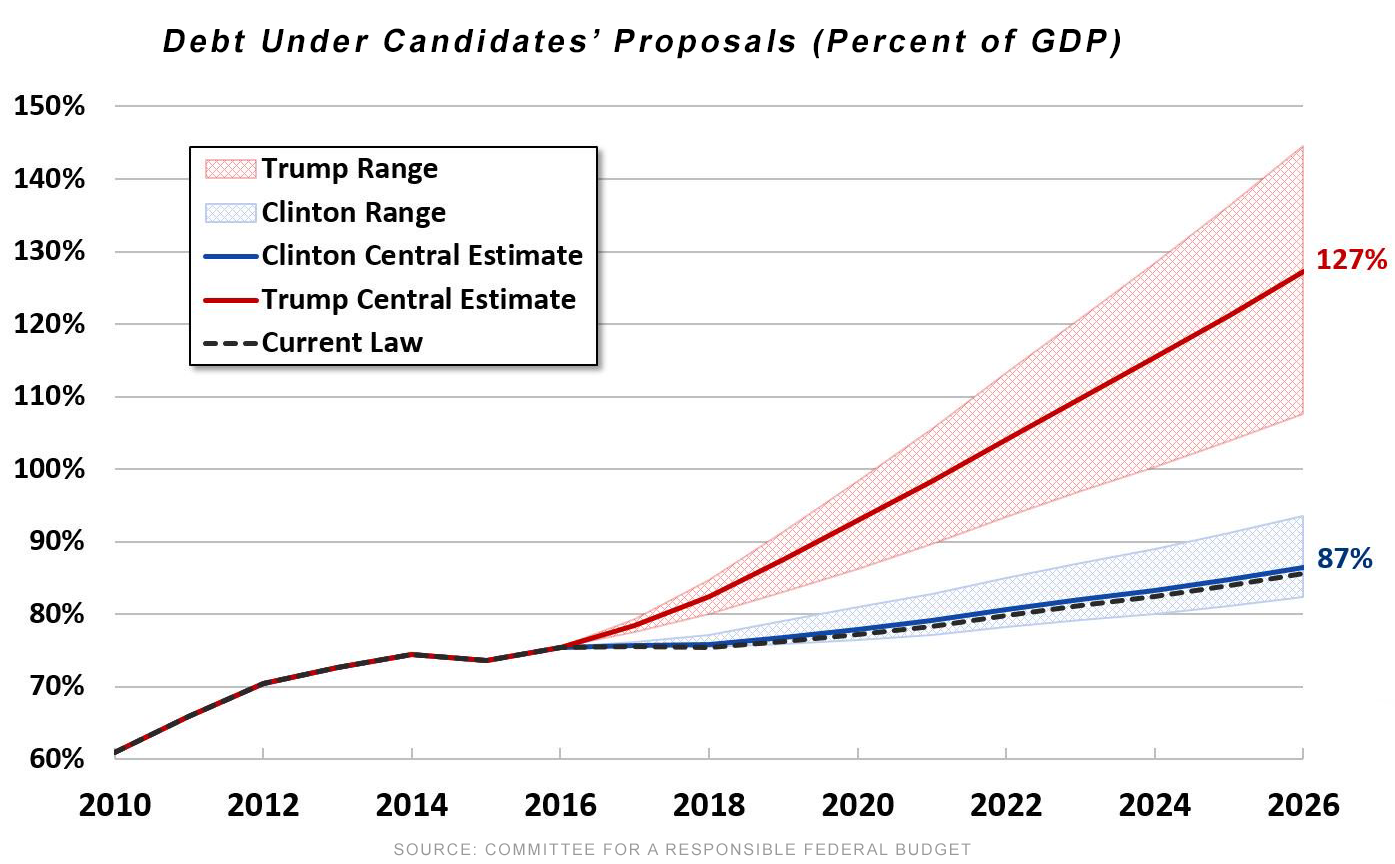

Tax Calculator: How Much Would You Pay Under Trump and Clinton

8.25 tax calculator

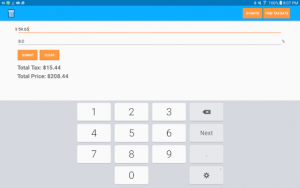

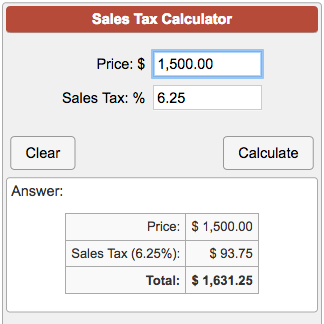

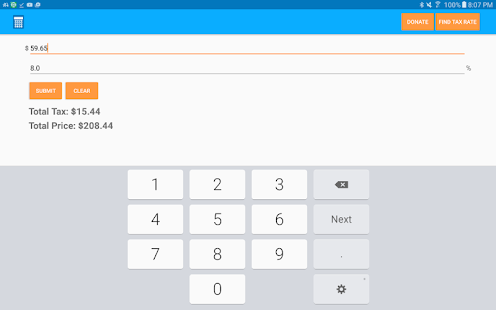

Sales Tax Calculator Apps on Google Play

Tax Schedules Templates