Vehicle Mileage Book Vehicle Mileage Log Book Ms Excel Editable

A physical mileage book can easily be lost or damaged, which can cause problems on the street. You can download a little and make the registration of your car or truck miles easy. You should read the appropriate IRS publication regarding this, as there are certain requirements and qualifications associated with each of these methods.

Each trip must be registered and the initial and final mileage at the end of the day to make sure they are accurate. If you work at home, it is considered your main location for business. It can also offer a mileage record that can withstand the scrutiny of the IRS. Your mileage log and mileage records can cause significant savings throughout the mileage deduction.

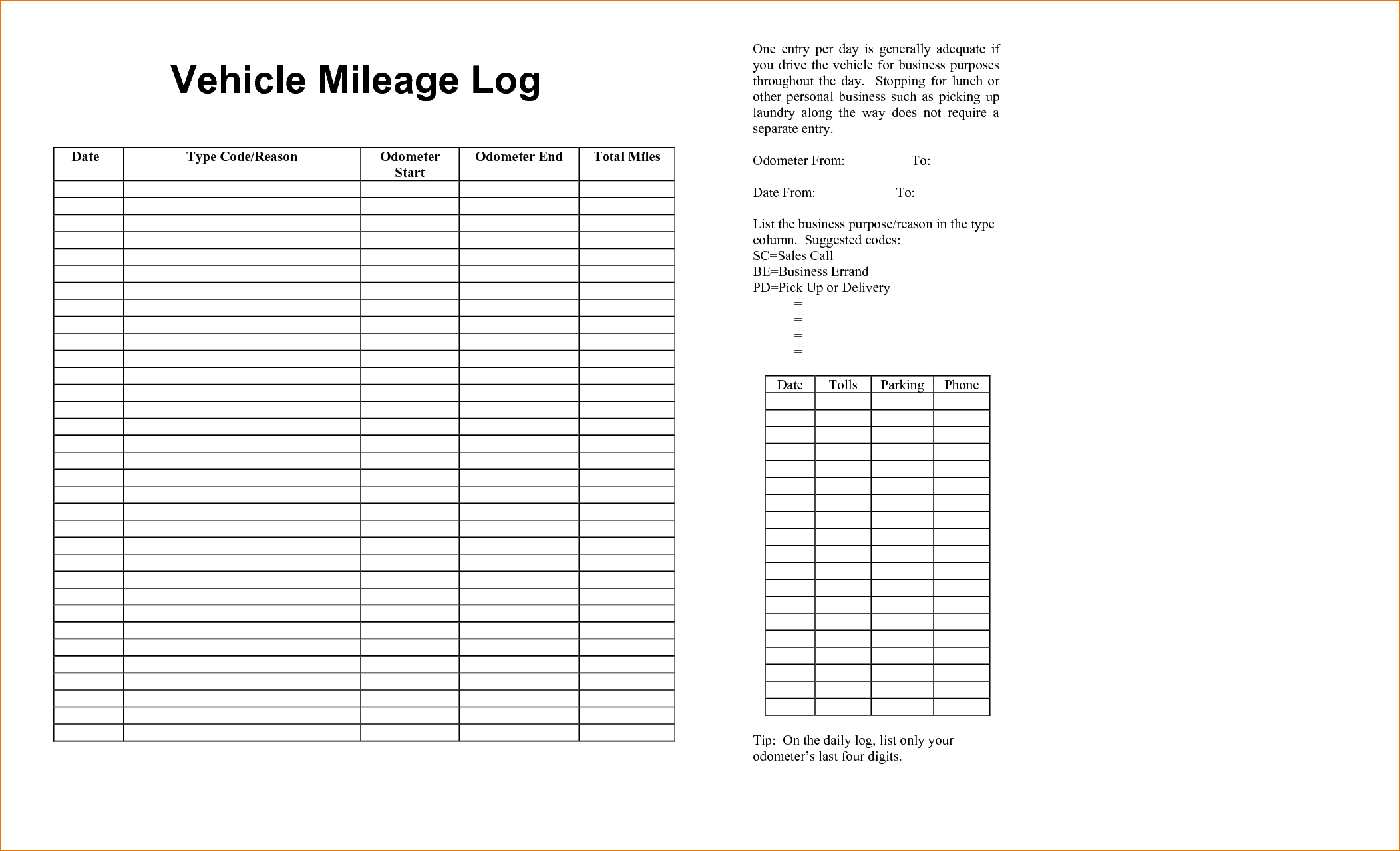

You must track the miles to avoid a possible audit. Maintaining a proper mileage record sheet can be the source of an extremely excellent deduction for your small business or reimburse you for your work miles. The other method for deducting mileage is through a proportion of the actual expenses of the commercial use of the automobile. You must record the mileage of business trips from the location of your small business to the destination of your organization and back to your company. One could be the typical mileage rate, which is determined by the IRS.

Even some of the business miles can definitely accumulate and save your taxes. This information must be recorded each time you start your trip to a destination related to the company. This is vital since you must continue to maintain your tax documents for years in case you ever face an IRS audit. The template will also allow you to calculate the amount you are owed. There are respective templates for such a registration book available online. This template will calculate the value of your company’s trips according to this figure. The template of the car mileage record book is not a hard job to get, since it is on the network and there is no need to search anywhere else, it is also available here.

If you want to use the actual expense method to lower your taxes, you can deduct the actual price of gasoline. Some people think that they can choose the deduction in case they use their travel time to make commercial calls or listen to recordings related to business. It does not matter what type of deduction you are taking at the end of the year. If you intend to select the mileage deduction, you do not need to maintain a gas registration book. You can use the standard mileage deduction or the actual expenses of the car. You will have a pre-established deduction for each of those miles.

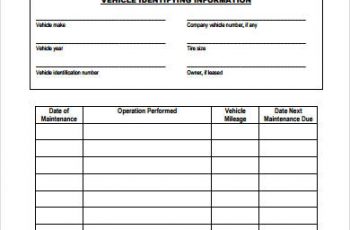

With the actual expense method, you will add up each of the expenses of the use of the car and the multiple by the proportion of use in the company. If you wish to deduct actual expenses, you must obtain an accurate record of all repairs and maintenance performed on the motor vehicle. This allows you to maintain the cost of fuel and manage it whenever it is essential that you achieve it. But if your business is out of your home, the mileage range between your home and your business is changing miles and is not deductible. Any company or employee that wants to deduct the mileage in taxes will have to have records to support those deductions. If you are an employee, make sure you understand what you can and can not deduct from your taxes. See how your mileage record books can help you avoid an audit.

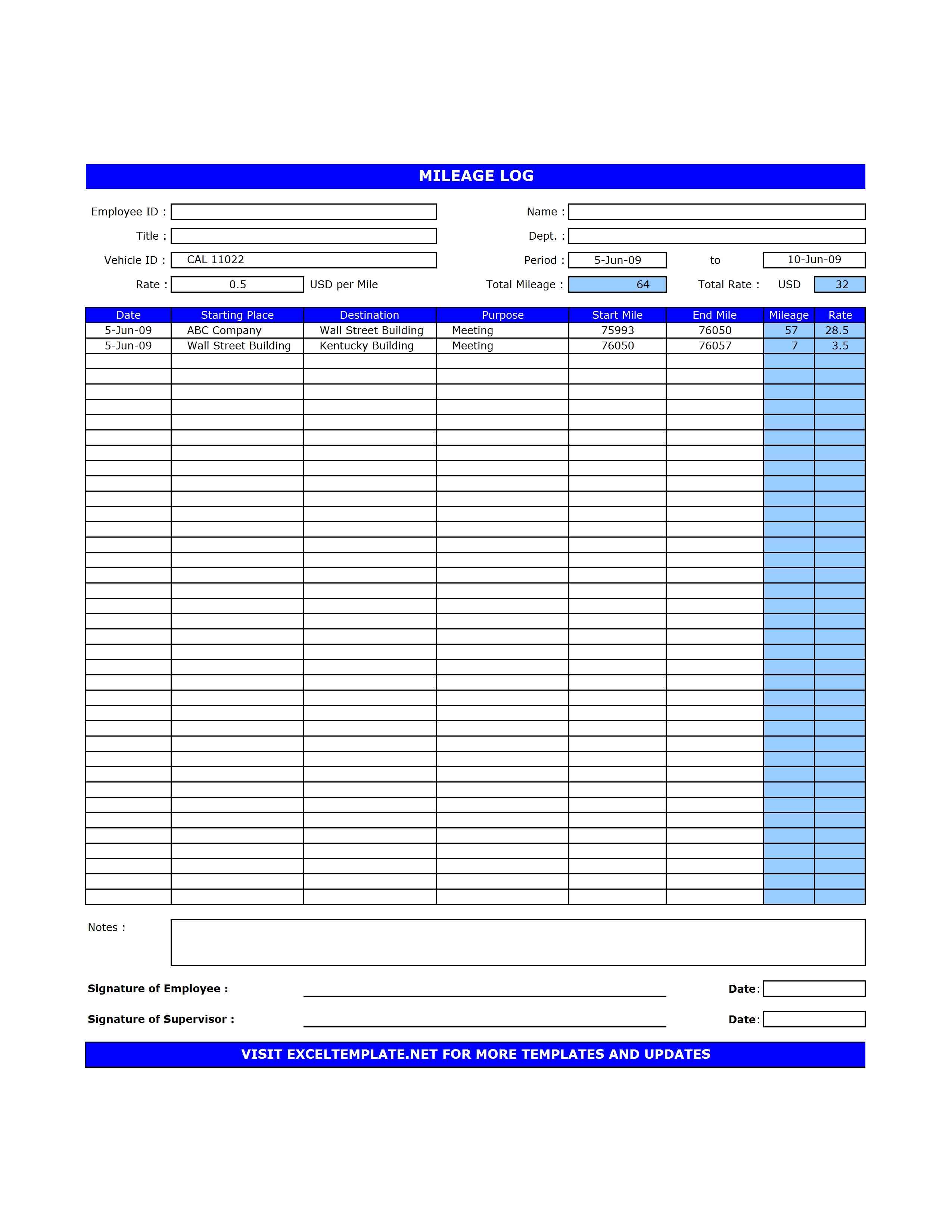

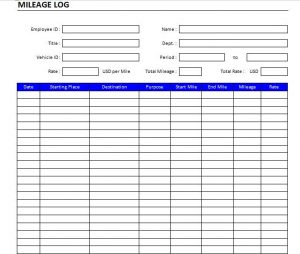

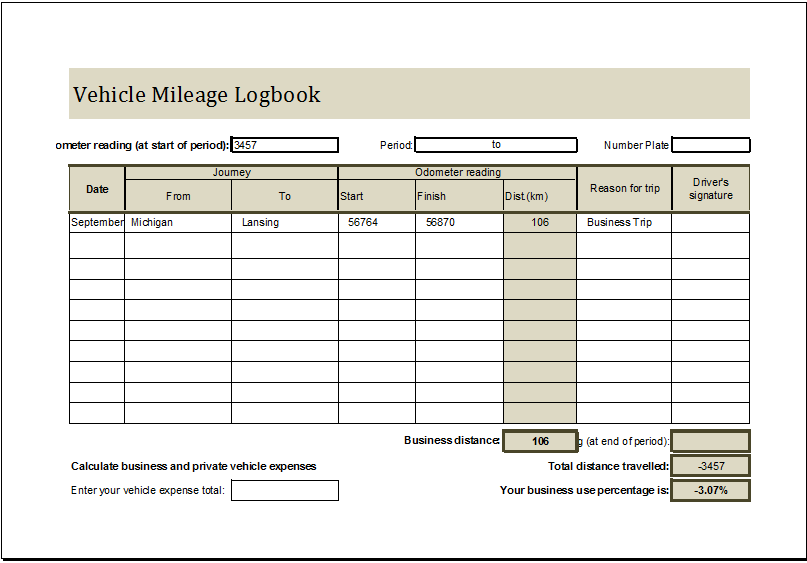

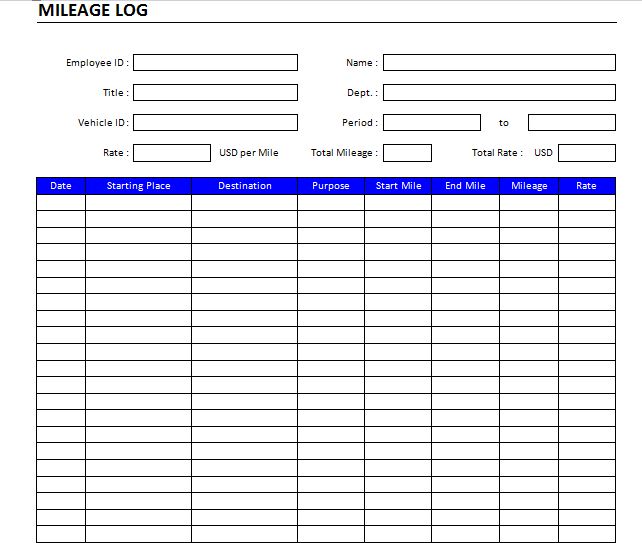

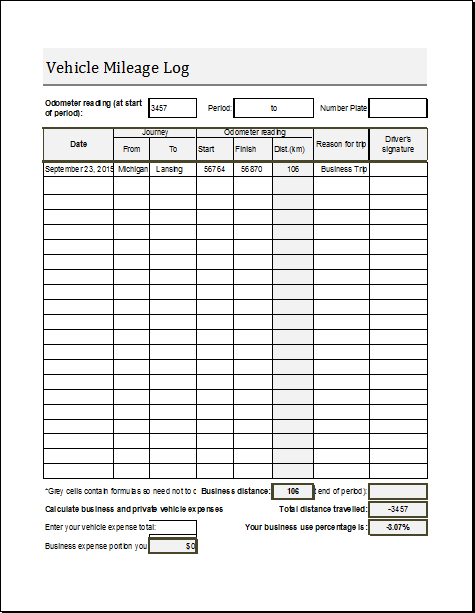

mileage log book template

auto mileage log book Kleo.beachfix.co

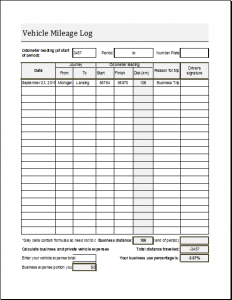

mileage log book template

mileage record book Kleo.beachfix.co

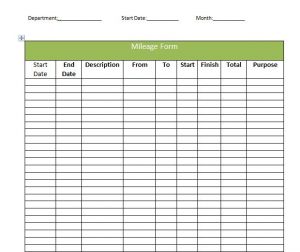

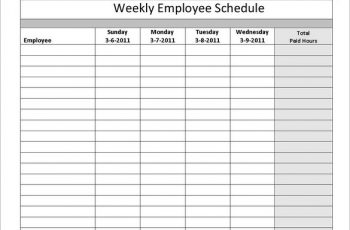

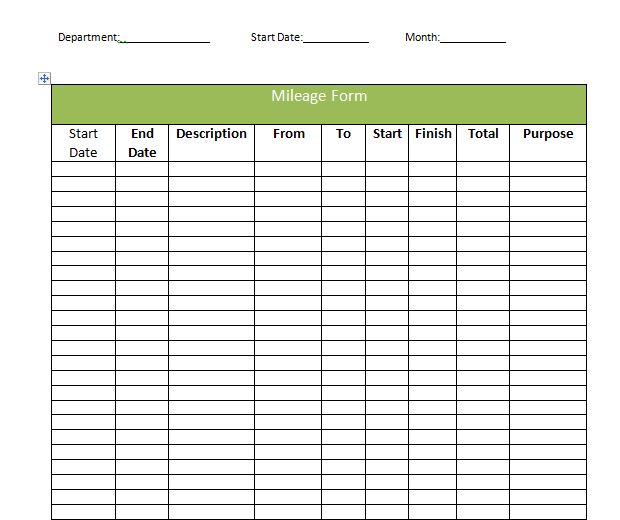

mileage log book template

free mileage log book Kleo.beachfix.co

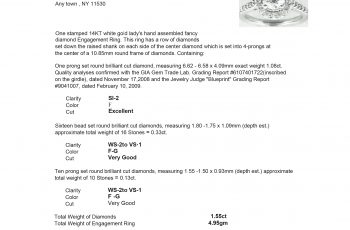

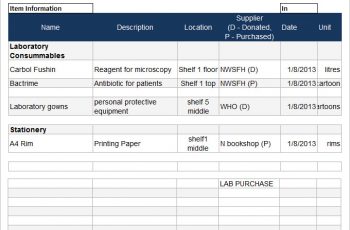

financial log book Kleo.beachfix.co