30 Printable Mileage Log Templates (Free) Template Lab

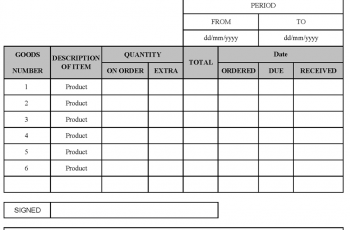

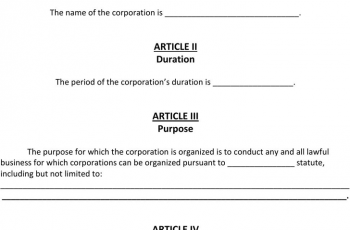

If you choose to use the template at the close of the month when you’re submitting your mileage for reimbursement, you’re able to quickly increase the fields if you are collecting the info in the identical format. The template is quite simple to use and is wholly free to download. It will also help you to calculate the amount you are owed. Your mileage template for Excel can readily be updated and changed if needed. Please be aware that whilst the majority of our templates are reviewed by a legal professional, because of the complexities of individual businesses we can’t guarantee their suitability for your intended application. Together with a bill of sale, you also have to be acquainted with a sales invoice template so you can make the sales receipt also.

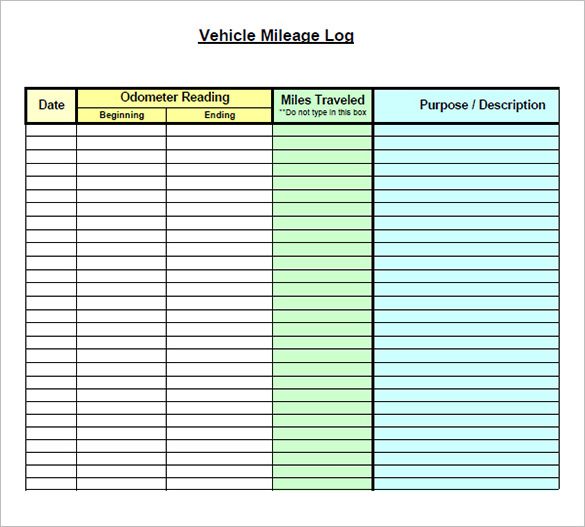

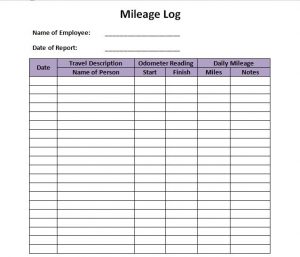

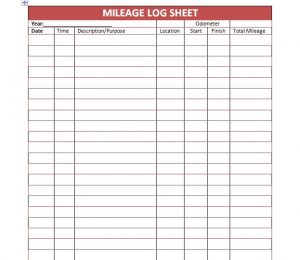

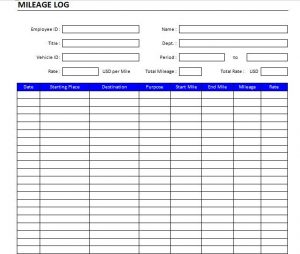

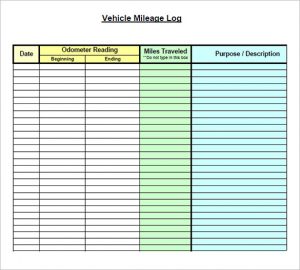

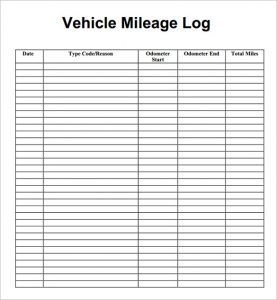

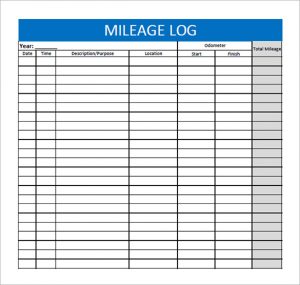

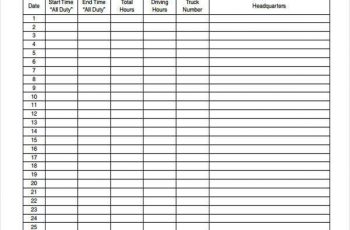

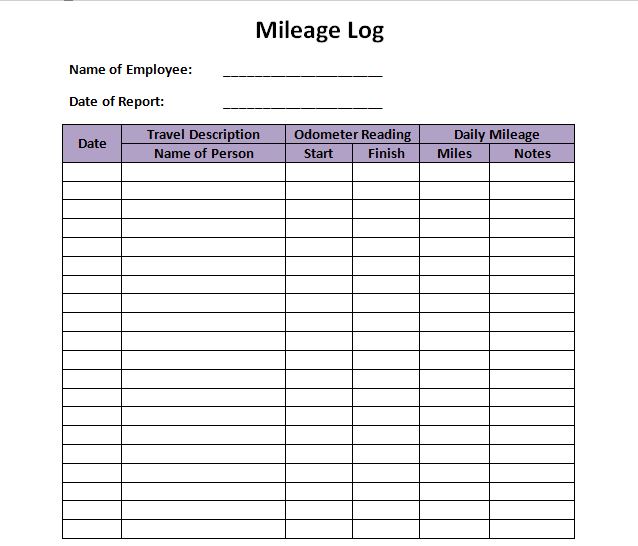

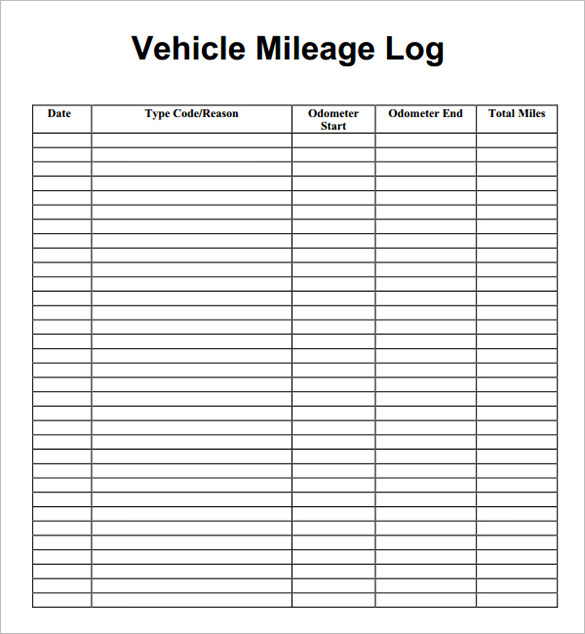

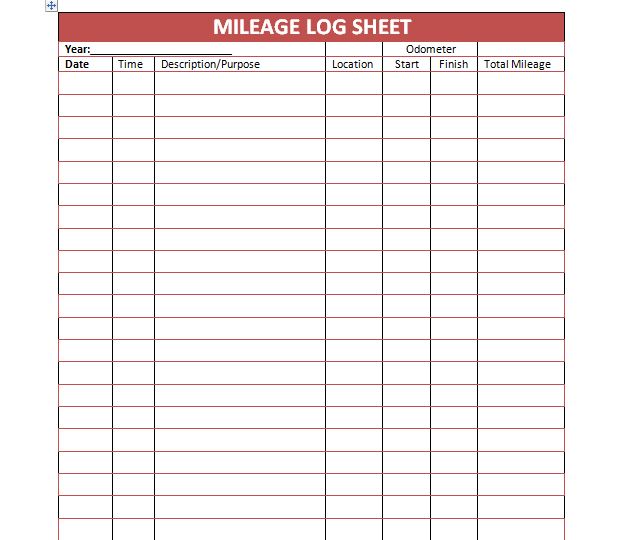

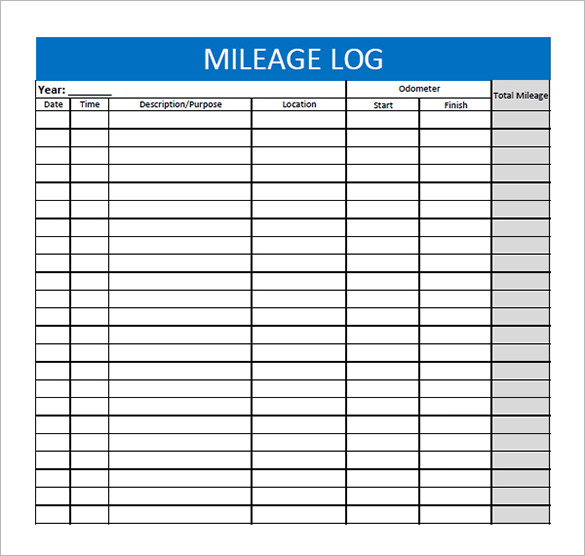

Your mileage log and mileage logs may lead to significant savings throughout the mileage deduction. A standard Mileage Log is going to be divided into seven columns. Mileage logs give big deductions and so when the IRS shows an illustration of a mileage log, they wish to make as a lot of hassle as possible! They are an essential part of anyA as they not only allow companies to keep a track of their employeesa work-based mileage information that can be used for travel reimbursement, but can also be used for tax return purposes. It is very important to update auto mileage log regularly because it is going to assist you in the audit practice.

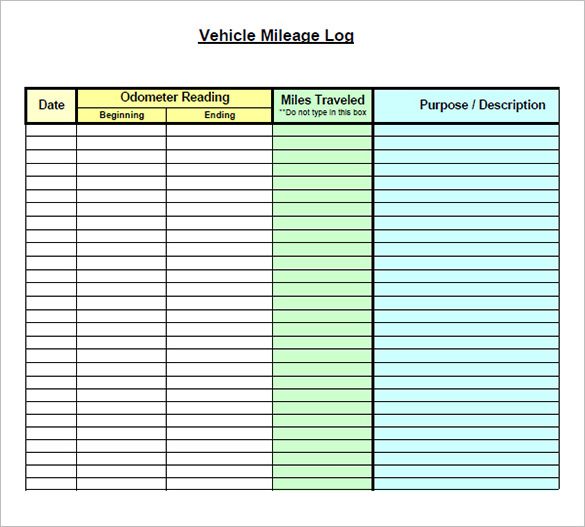

As you construct your mileage spreadsheet be certain to keep in mind that you would like it to be obvious to the user how to perform the easy job of entering their mileage claims. Utilizing a spreadsheet for your mileage log can supply you with an easier and more effective method to keep an eye on your organization or individual expenses anytime you get behind the wheel. Simple spreadsheets you could set up using software such as Microsoft Excel can help you keep on top of it all.

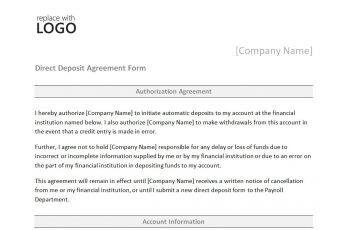

A bill of sale includes details about the 2 parties involved with the agreement and details about the product which is being purchased by the purchaser. If you intend to use the actual expense method to lessen your taxes, you can deduct the true price of gasoline. Some people think that they can choose the deduction should they use their commuting time to earn business calls or listen to business-related recordings. If you want to select the mileage deduction, you don’t need to maintain a gas logbook. You may use the standard mileage deduction or the real expenses for the automobile. With the true expense method, you total up all the expenses from the usage of the car and multiple by the proportion of use in the company. If you intend to deduct actual costs, you have to get a precise record of all maintenance and repairs done on the motor vehicle.

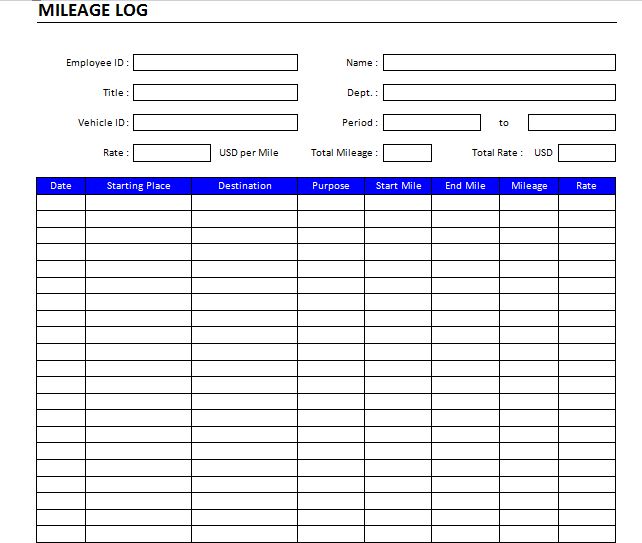

Documentation to file for car expenses If you’ve got a vehicle and you own a business, it’s highly probable that a few of your driving is for business and can develop into a legitimate business expense deduction. If you’re using car of the business then you need to keep the record of mileage log. Car mileage is the initial credential which functions as the deciding factor of taking any new vehicle. The other method to deduct mileage is via a proportion of actual expenses from business use of the automobile. Claiming business mileage helps lessen your company profits, and thus the sum of tax you pay at the close of the year. You need to record the mileage for business trips from your small business location to your enterprise destination and back to your company.

mileage form template

30 Printable Mileage Log Templates (Free) Template Lab

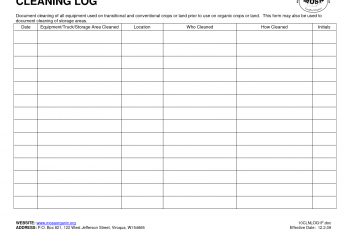

mileage form template

30 Printable Mileage Log Templates (Free) Template Lab

mileage form template

mileage form Kleo.beachfix.co

Mileage Reimbursement Form Template