Legal Notices |

If you do not feel comfortable incorporating your Church on your own, then you should consider getting the guidance of a lawyer or accountant to prepare the organizing document of your Church. Churches need to increase money for virtually any variety of factors. Be sure to approve the church plan for your vehicle.

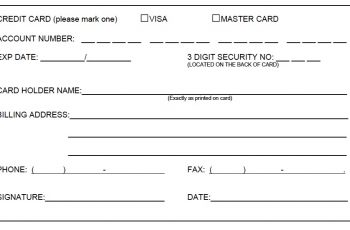

No matter the reason, donations are essential for practically any organization. Do not forget that donations to individuals will not meet the requirements for a tax deduction. They are the soul of many churches. In the case of a donation of cash, you can leave the total donated. It can be hard to donate to charity every time you are not doing too much. Charities are definitely the most frequent cause of donations.

The donor may have to file an amended return. If he or she does not provide the proper information, you can not claim your donation on your taxes. You are deciding for your donors how to dedicate a part of their gift that is not directly related to your ministry.

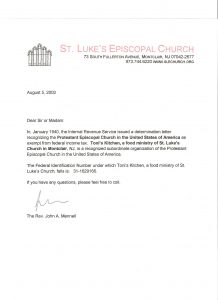

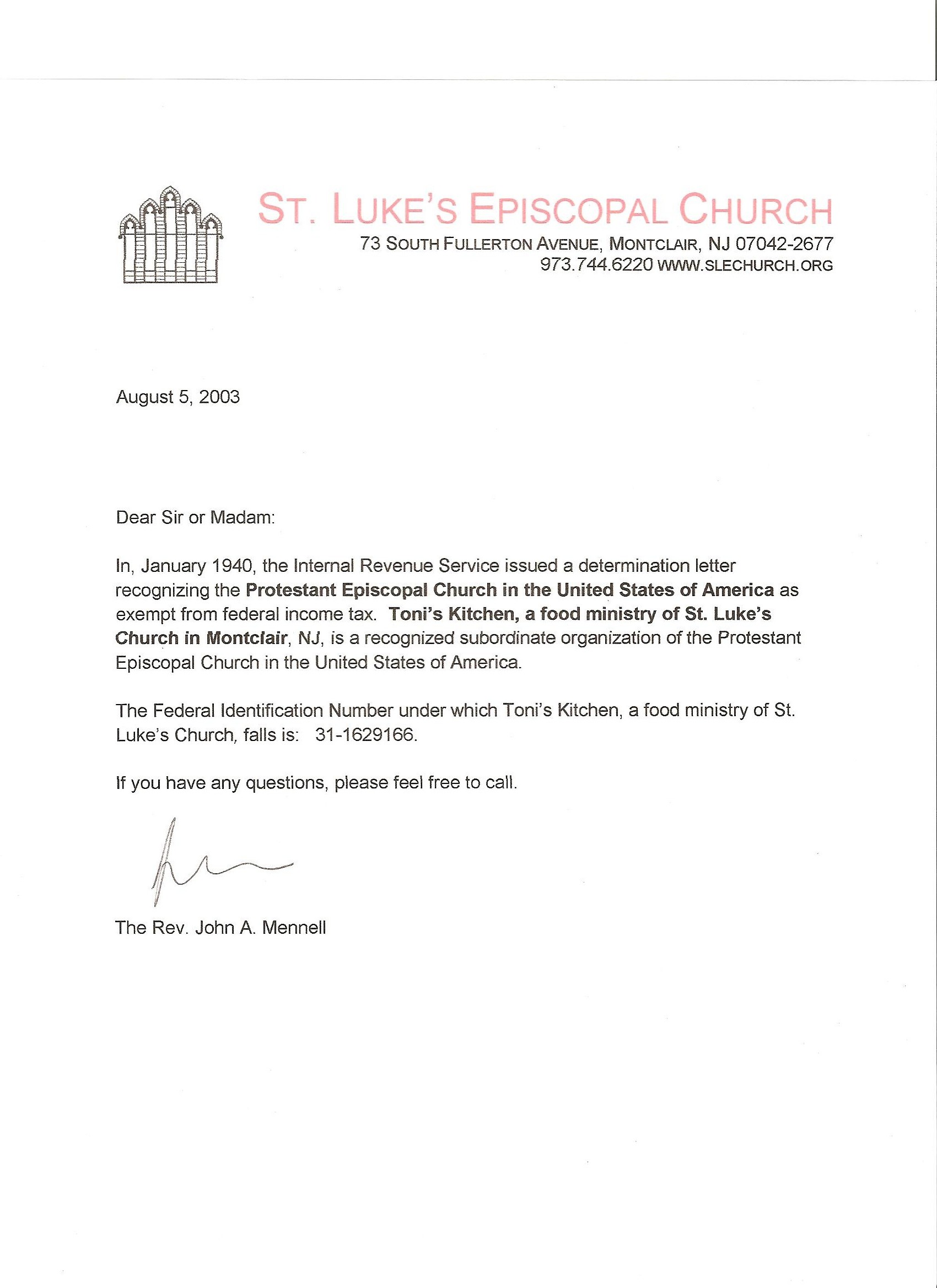

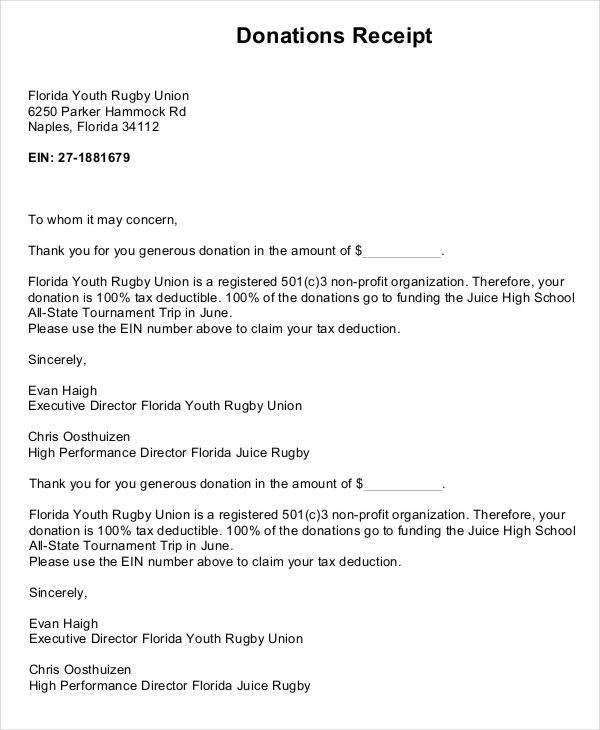

Be sure to ask for a donation receipt from the church for any contribution you make. All charitable contributions must be made to a professional charity. If you intend to earn a contribution to your church or diocesan institution before the end of the calendar year, consider donating appreciated shares of your investment portfolio.

An organization can avoid the fine if it can show that the non-compliance with the requirements was due to a reasonable cause. For example, many organizations use marketing campaigns to encourage people to create donations. A non-profit organization is not different from any other company in which it has to make ends meet.

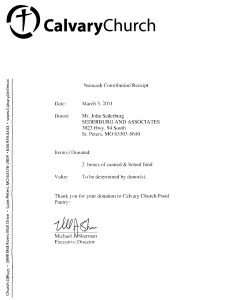

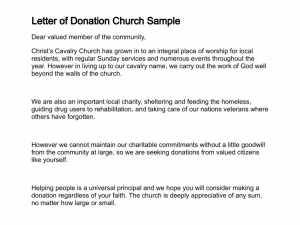

If you are responsible for generating receipts, look using one of the following samples. Often, in the case of large donations, people receive a personalized thank you letter. You can not deduct contributions to certain people who, however, merit it. There are still many generous people and business owners who are inclined to do well locally through a church.

If you need help to create a Gift Policy, please contact us. If you need help downloading the templates, take a look at the helpful tips from Adobe. When there is a distinct demand for something, we collect donations.

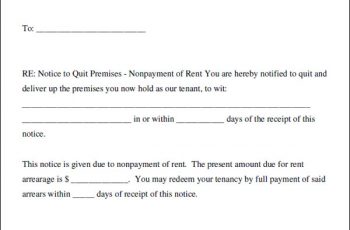

The statement must be in writing and must be produced in a style that is likely to be in the interest of the donor. The statement of no-goods-or-services is another vital facet of the charity receipt. Now that you know what to put in the end-of-year donation statements and receipts, you can produce a template. Thank you letters do not need to be long. Be sure to direct your letters to people who have a strong interest in the distinctive projects your church is carrying out. Use bold letters so you can see clearly.

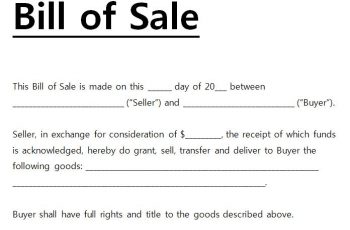

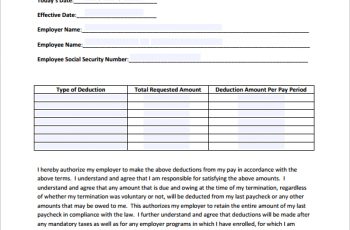

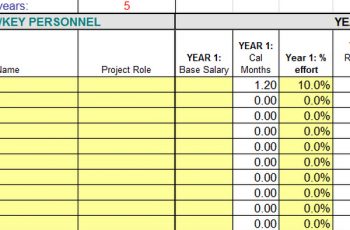

The receipt template is a Microsoft Word document so you can customize it to meet your needs. The donation receipt template is quite simple to use. Our Donation letter templates were created to help you with your cause. They can be easily edited so you can change the cause as needed.

church donation letter for tax purposes

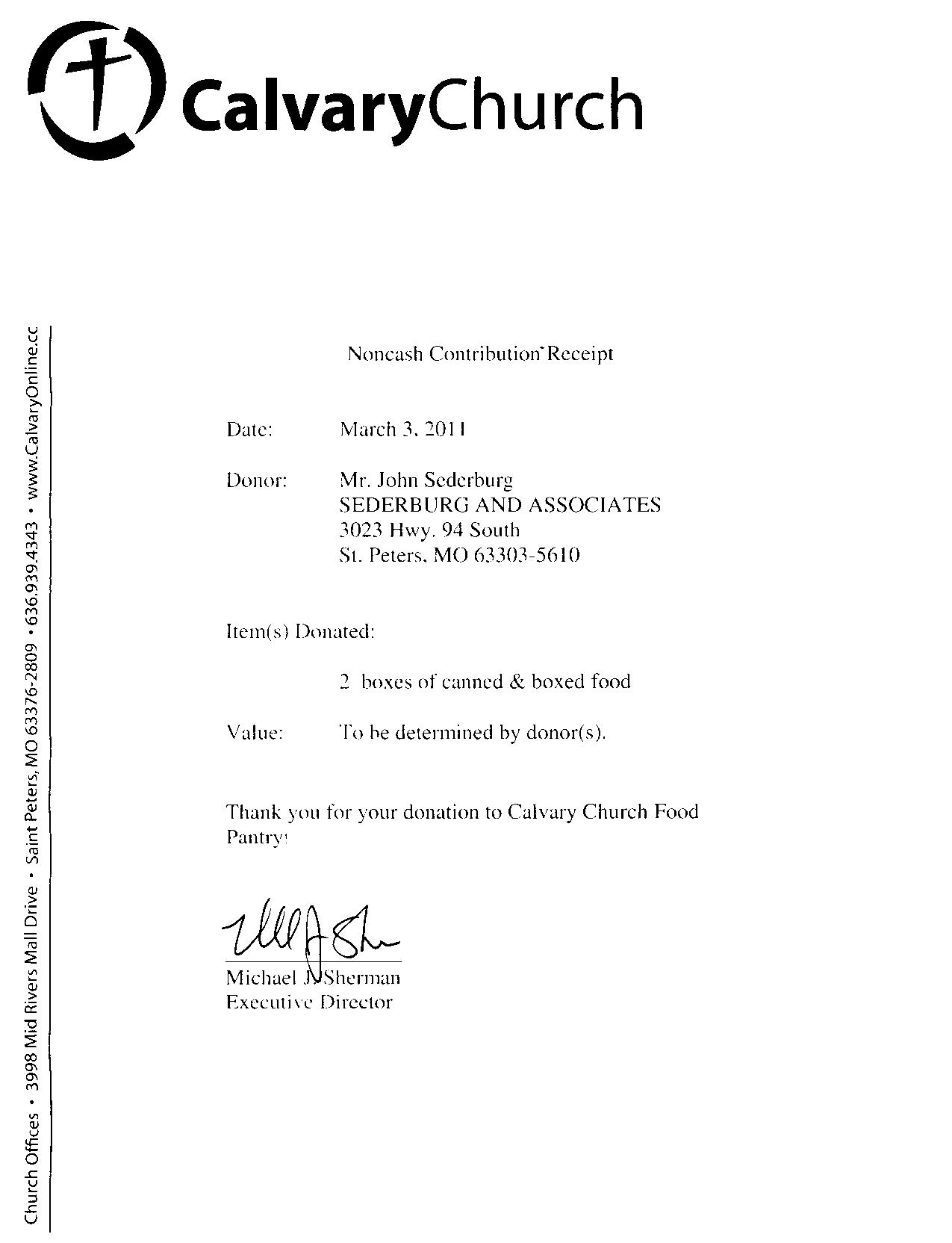

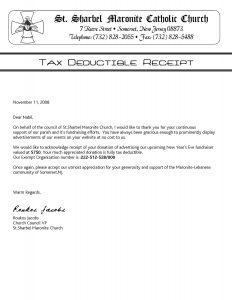

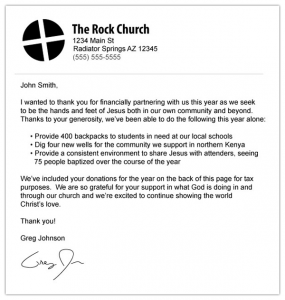

Donation Receipt Letter Design Templates

church donation letter for tax purposes

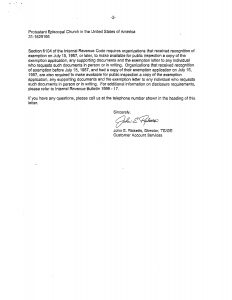

501c3 donation receipt Kleo.beachfix.co

church donation letter for tax purposes

Legal Notices |

17+ church donation letters | weddingsinger on the road