charity pledge form template donation form template 8free word pdf

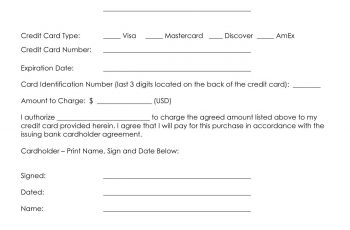

In the event that the donor gives something other than cash, such as a bit of property or books, it is the obligation of the donor to make an adequate assessment for its registration. If he or she does not provide the proper information, you can not claim your donation on your taxes. Unfortunately, many donors do not keep this information.

A donation is a good method to leave a legacy. Keep in mind that donations to people will not meet the requirements for a tax deduction. Therefore, you should not be shy to take advantage of your potential for donations. It may be more effective to incorporate a check box I would like to earn a donation on your contact form as an alternative to the donation button alone.

A donation is protected by law. Your donation will have a dramatic effect on the life of a young man. Donations of items must be in good condition to be eligible for a deduction. According to this, they are quietly popular in terms of charities. Donations in memory are also sometimes granted by men and women if they can not attend the ceremony. It may seem easy to understand, but this concept also involves legal complexities. The donation of the use of materials, equipment or facilities is not recognized as income.

There are several reasons for composing the donation letters. Therefore, here are some tips that can help you write a better and more efficient donation letter. Writing donation letters is not really easy, since you must persuade readers. As with standard donation letters, these letters can also be adapted to suit the needs of the organization. In the same way, writing letters of request for donation is not a cup of tea for everyone. Therefore, here are some things you should learn before you start writing donation request letters.

Your employer can participate in a charitable giving program that allows you to make contributions directly from your paycheck. It is also possible to make a charitable deduction if a student lives at home under a professional program. You can claim the complete charitable deduction only if you reject the CD player.

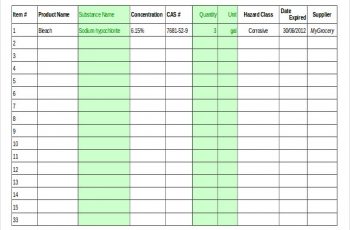

The small details can make a difference. For donations that are not cash, a more detailed description of the merchandise or donated items must be included. More information can be found at IRS.gov. Also, be sure to provide specific information in the letter. Obviously, it is not enough to simply say what happens with the donation pages. Repairing your donations page is probably the biggest bang-by-buck improvement you can make on your site. This guide presents a summary of the main compliance difficulties of charitable auctions and how to use donor education as part of compliance.

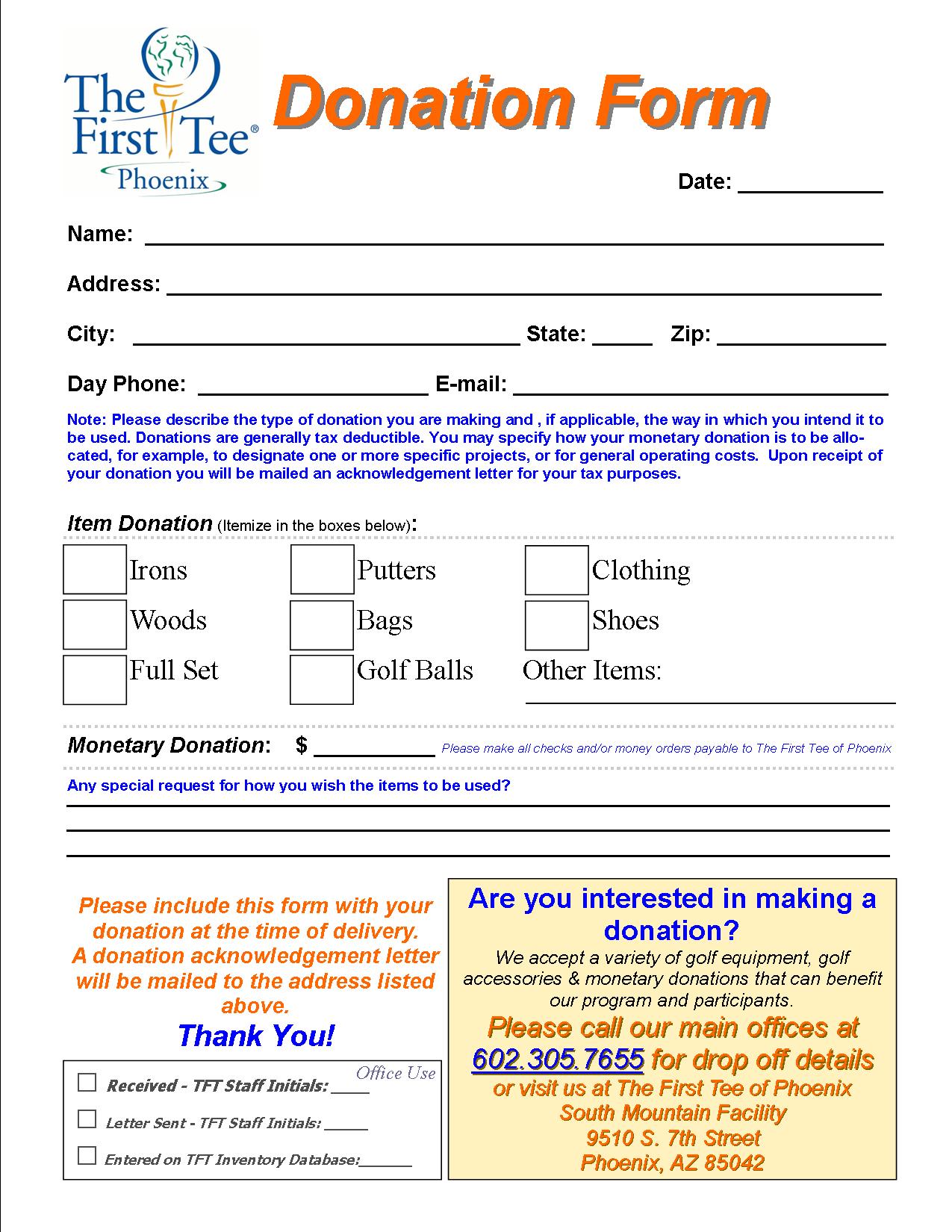

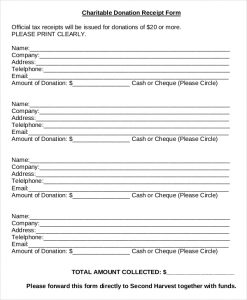

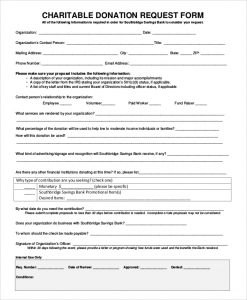

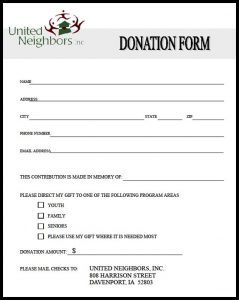

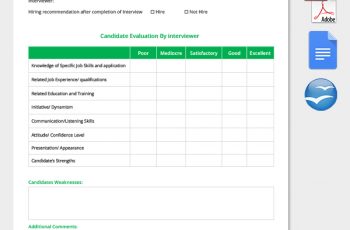

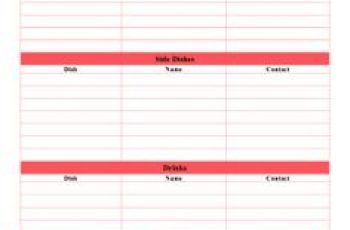

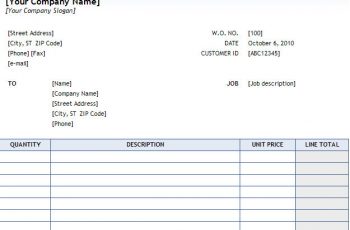

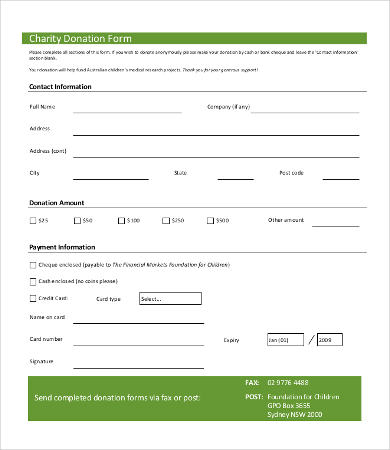

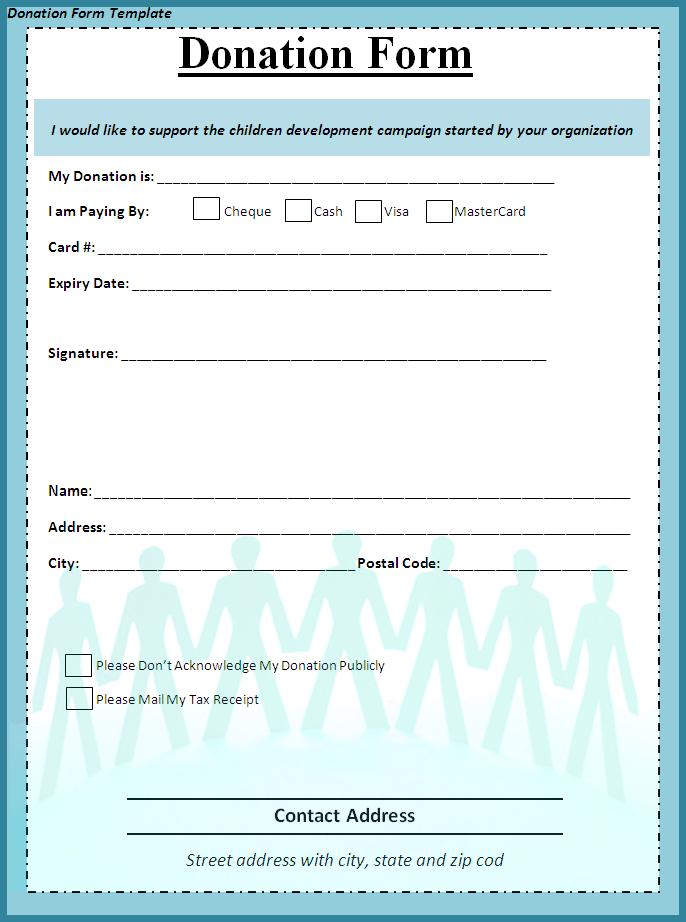

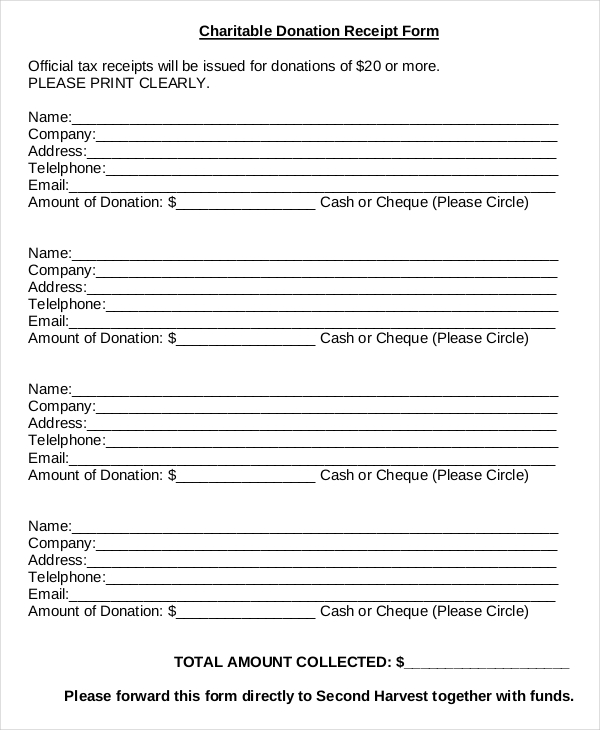

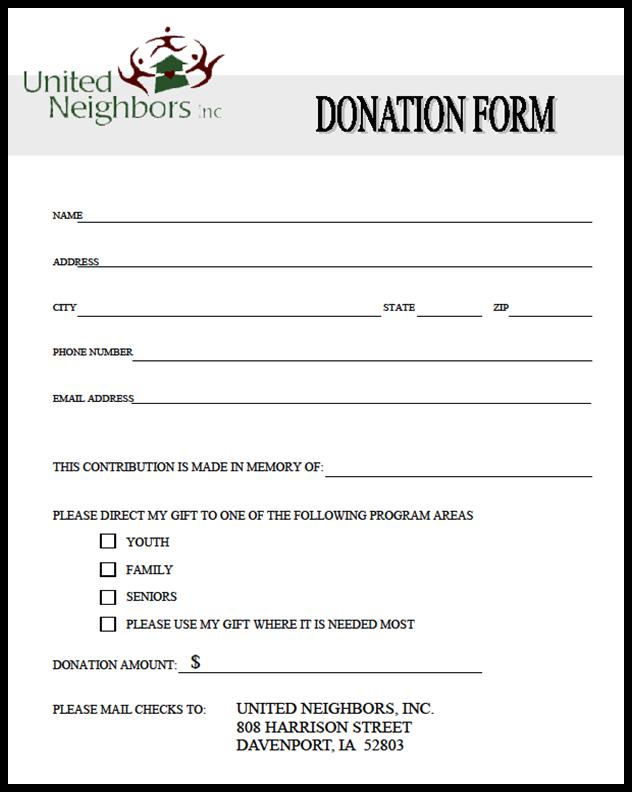

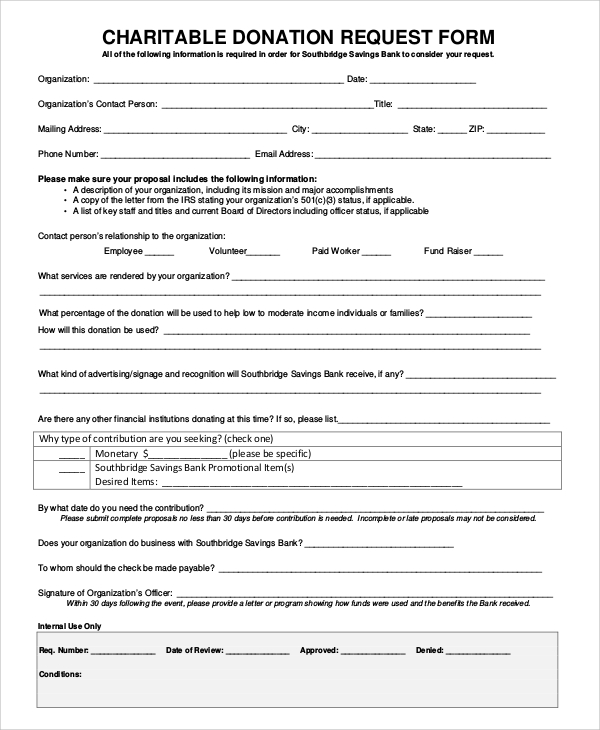

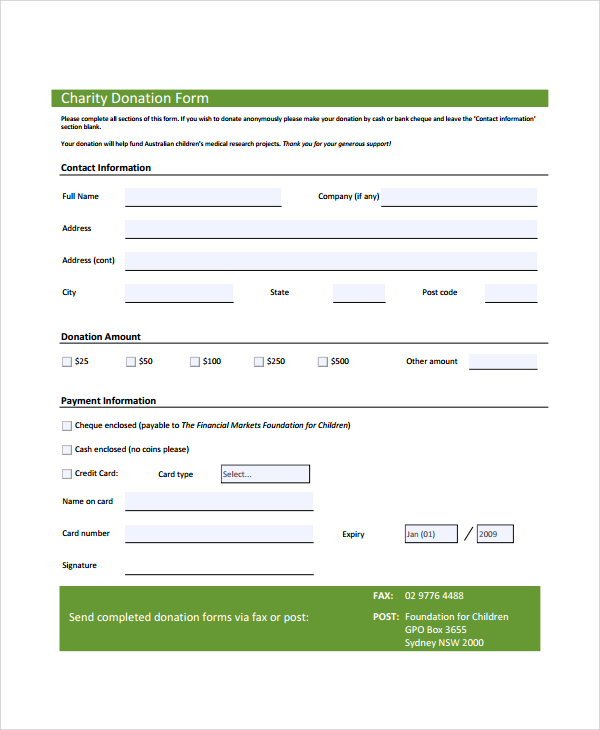

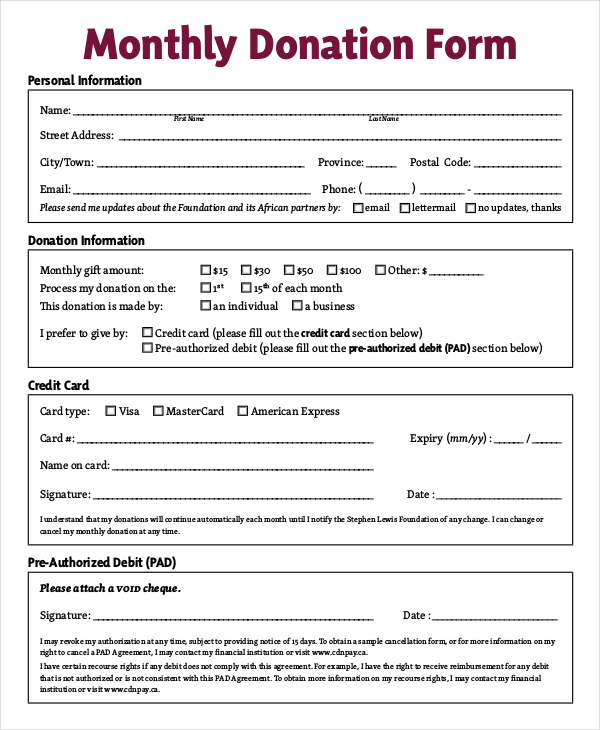

You can discover various forms of donation letter templates that will help you here. The donation receipt template is extremely simple to use. In addition, there are many templates apart from the standard format that can be found on our main site. It is possible to find several types of donation request form templates available on our main site. The form and instructions are offered on the IRS website and can be obtained through this link, IRS Tax Forms. If the donation form is made taking into account all the fields and vital categories, the whole process is easy and effortless. No matter what type of charity you are responsible for managing, a donation receipt form is something you will need in a normal way.

charitable donation form template

donation form template

charitable donation form template

pledge form templates Kleo.beachfix.co

charitable donation form template

7+ Sample Donation Forms | Sample Templates

charity pledge form template charitable contribution form template