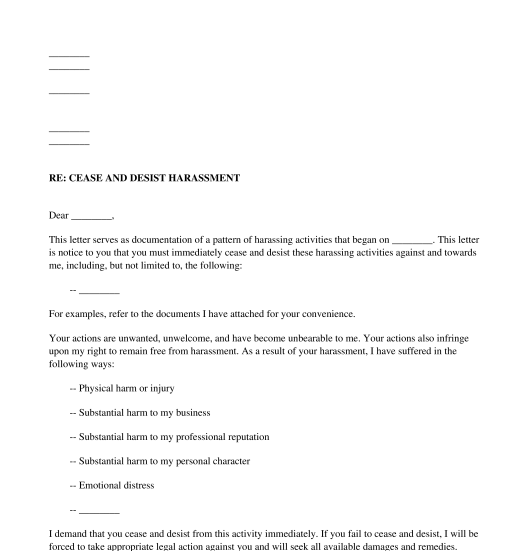

Harassment Cease and Desist Letter FREE Template

Who better than a person who dominates the law and has experience in the business. When represented by a lawyer, the debt collector can not contact a third party for virtually any information about you. You do not need a lawyer to file any bankruptcy chapter. The plaintiff waves a piece of blank paper in front of you. In the end, do not forget that your employer already had many opportunities to ask you about your comments before choosing to leave. Before continuing, he wants to judge how serious the harassment is. Serious and continuous harassment can cause a nervous breakdown and a plethora of health problems if it does not stop.

Do not use credit cards to cover things you can not pay. Be sure to pay for your credit card or, if you can not do so, try using another credit card. Close all credit cards except one if you want to repair your credit score. There are consequences, your credit may take a bit of ding for a result. If you do not have any debt, your credit rating will increase. Dedicate as many financial resources as possible to eliminate debts, but keep a fair budget as you do. As stated by Fair Isaac Company, your debt to credit ratio represents more than 30% of your score, therefore, it is absolutely important to eliminate your debt first when you are trying to improve your credit rating.

If a debt collector contacts you, inform them that the person they are trying to contact is dead. Debt collectors do not have the right to deduct the payment of a debt other than the one you mentioned. They should be informed of their lawyer and should only contact him once he hires a lawyer. No matter the status of your debt if creditors harass you, you can hire a lawyer who is well versed in FDCPA. Debt collectors should mention the most appropriate amount you owe. Apart from that, they are not allowed to discuss the debt with others, although they are allowed to contact others to gather their contact information. Debt collectors of third parties buy debt from the original creditors for an extremely modest price and have nothing to eliminate in terms of money.

Make sure that the credit score repair agency you are working with is legitimate. For example, the collection agency and the collector’s license is something that no collection agency wants to provide, since you will know the information of agencies and agents. Most collection agencies will not react to your letter, as they can not offer the proof or information you request. They also can not contact you at work if they do not have permission to do so. Debt collection agencies can be the most stressful part of a poor credit crisis.

In summary, there is no simple answer to create DYFS disappear and there is no easy answer to the question of whether an individual has to meet their demands. This advice can help you easily repair your negative credit. Now that you are armed with the information you need to fix your credit, do not postpone the implementation of your plan. However, you must remove inaccurate information from your report, but you do not need the help of a consultant to achieve it. With just a couple of important strokes, a lot of patience and motivation, an individual can discover a variety of interesting information about dealing with collection agencies and their scoundrels collectors.

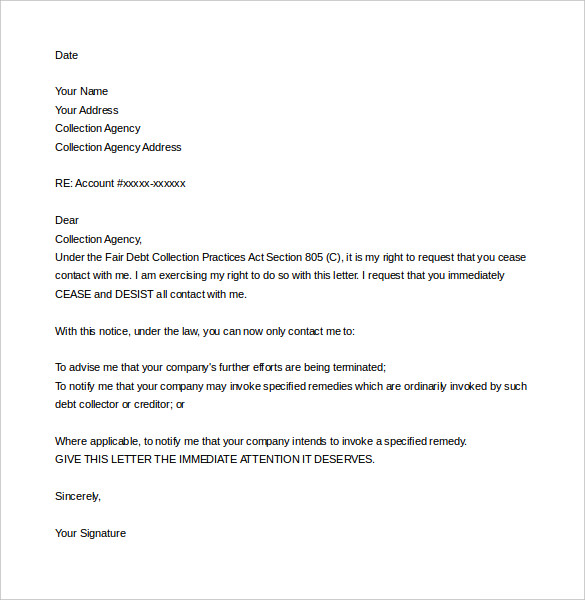

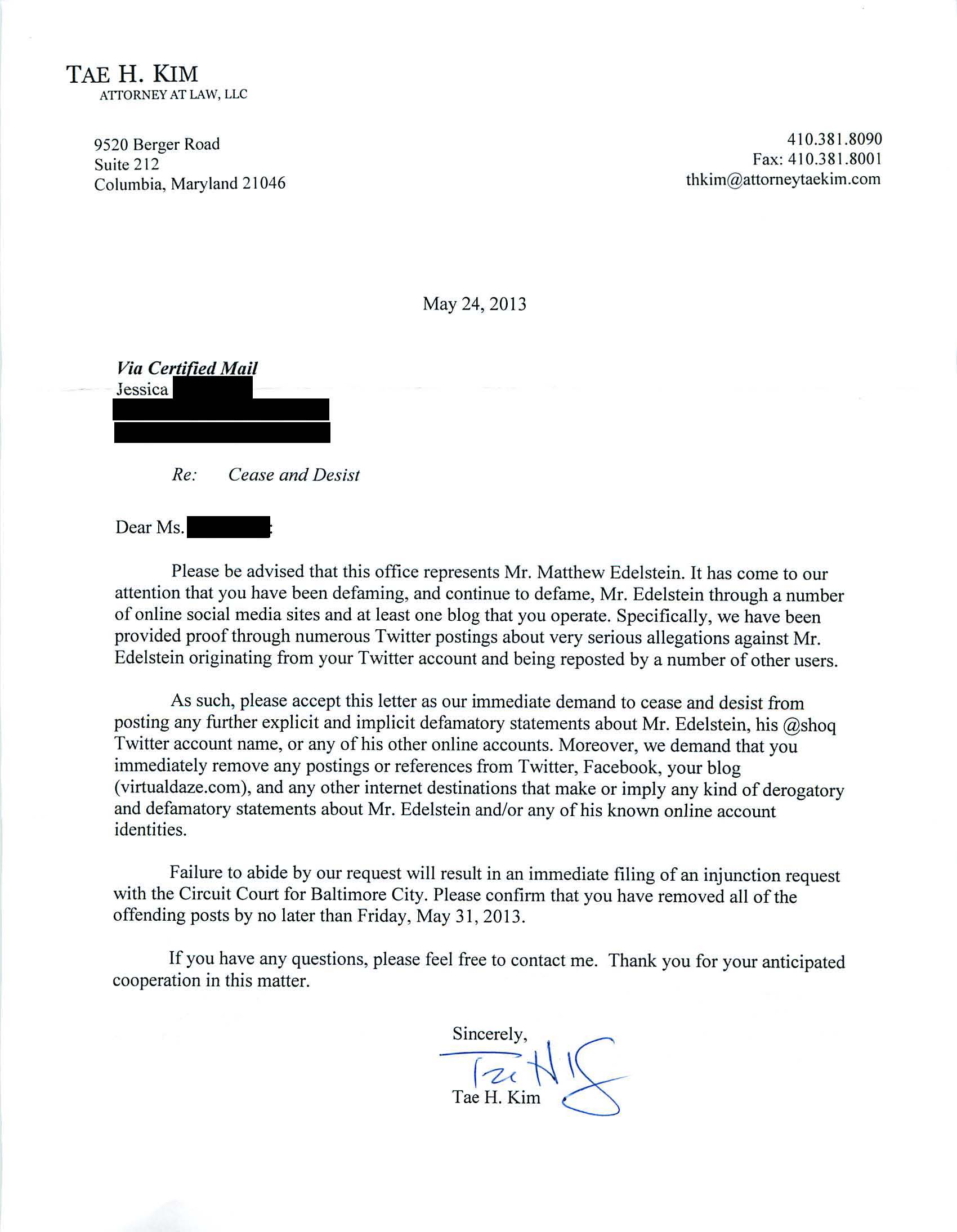

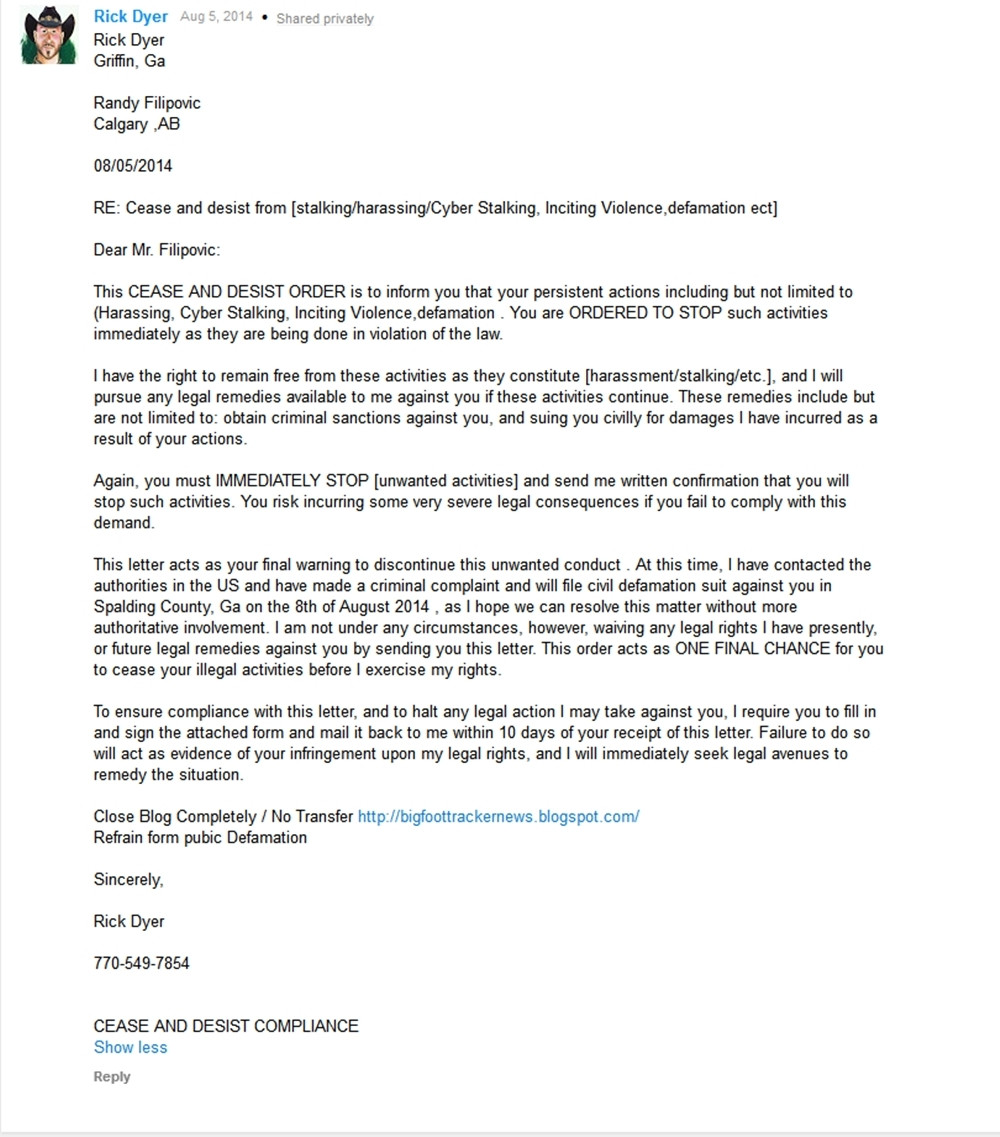

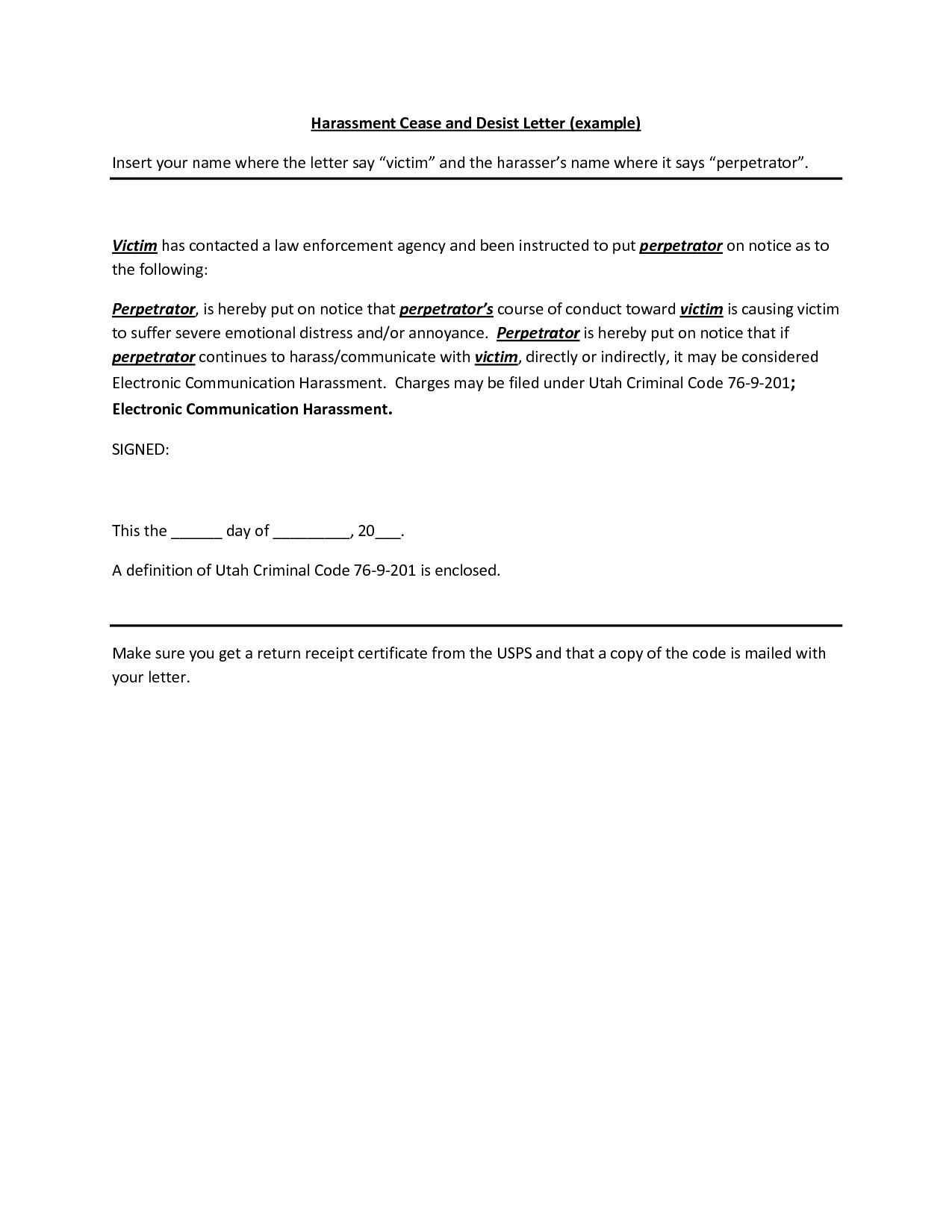

cease and desist letter harassment

Cease and Desist Letter Template – 6+ Free Word, PDF Documents

cease and desist letter harassment

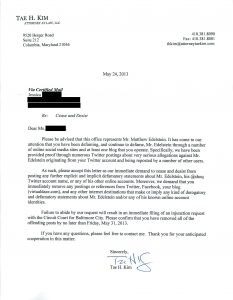

Cease and Desist Harassment Template

cease and desist letter harassment

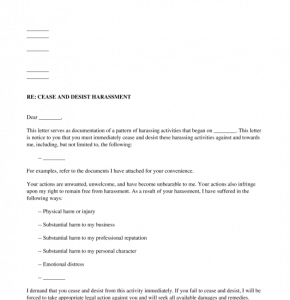

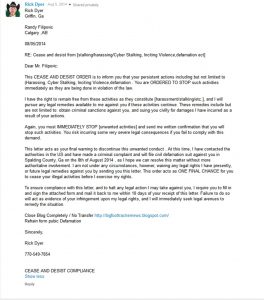

cease and desist letter harassment Forms and Templates Fillable

Psa Template Best Cease And Des Awesome Cease And Desist Letter